Is an interest free or interest rate based micro saving financial service that enables telebirr customers to securely save money with ordinary and locked options,

| Sinq Type | Deposit amount | Interest Rate based on the principal amount | Maturity Date |

|---|---|---|---|

| Ordinary (Interest Bearing) | >1 Birr | 7% | -- |

| Ordinary Non-Interest Bearing) | >1 Birr | --- | -- |

| Locked (Fixed Deposit) | >20,000 Birr | 7.25% | 3 Months |

| 7.5% | 6 Months | ||

| 7.75 | 9 Months | ||

| 8% | 12 Months |

- This account allows customers to lock a specific amount of cash for a specified period of time as mentioned on the table.

- Early withdrawal of funds from locked Sinq is allowed but the interest rate will be calculated based on ordinary Sinq (7%).

- If their money remains in the account after the maturity date, the interest rate will continue.

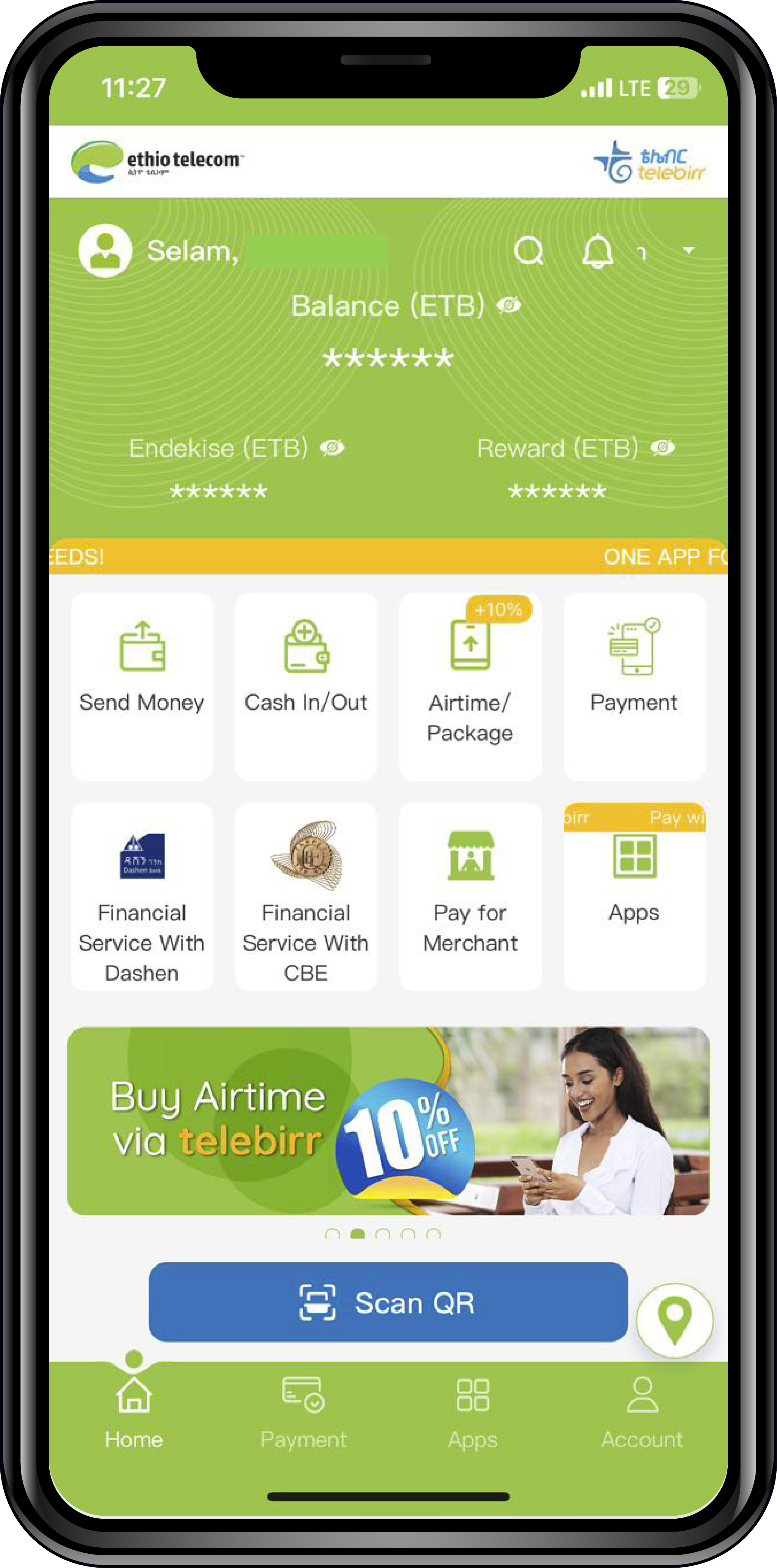

- Select Financial service with CBE

- Choose among Enderas credit options

- Enter amount

- Confirm after reviewing the details

- The Agreement

- This Agreement sets out the complete Terms and Conditions (hereinafter called " These Terms and Conditions") which shall be applicable to Sinq Service.

- These Terms and Conditions and any amendments or variations thereto take effect on their date of publication.

- Definitions

In these Terms and Conditions, the following words and expressions bear the following meanings

- “Ordinary Sinq Service” means a financial service that enables telebirr customers to securely save money using telebirr SuperApp and *127# which enables customers to earn interest on the stored value.

- “Locked Sinq Service” means a fixed Sinqs account that allows customers to lock a specific amount of money for a specified period of time.

- “Customer” means an individual in whose name the Sinq service with telebirr account is exist.

- “You” or "your" means the individual customer and includes the personal representatives of the individual;

- “We,” “our,” and “us,” means Commercial Bank of Ethiopia and Ethio telecom;

- “E-Money” means the electronic monetary value depicted in customers telebirr Account representing an equal amount of cash.

- “Sinq Interest” means the amount calculated, accrued, and paid to tele birr customers based on the daily balance of customer's Sinq deposit.

- “Principal amount” means the amount of money initially deposited by customers.

- Acceptance of the Terms and Conditions

- Before applying to use Sinq service, you should carefully read and understand these Terms and Conditions which will govern the use and operation of Sinq service.

- If you do not agree with these Terms and Conditions, please click “Cancel” on the Menu.

- You will be deemed to have read, understood and accepted these Terms and Conditions:

- Upon clicking on the “Agree” option on the Menu requesting you to confirm that you have read, understood and agreed to abide with these Terms and Conditions; and/or by using or continuing to use and operate Sinq Service.

- Ethio telecom may alter or vary these Terms and Conditions at any time, and such amendments or variations take effect on the day of publication.

- From the time it is accepted electronically, these terms and conditions become a legally binding agreement between you and us. You are not allowed to transfer any of your rights or obligations under this agreement to anyone else.

- You acknowledge and accept the Sinq service only electronically and you agree to do business with Ethio telecom and to operate the Sinq service only by electronic means via telebirr system.

- Activation for Sinq Service

- To activate Sinq Service with Ethio telecom, you must be at least:

- 18-year-old and Above

- Have an Ethio telecom SIM card

- telebirr age three month

- You can use USSD (*127#) or telebirr Superapp to activate the service.

- You will receive a notification for successful activation.

- Once activated for Sinq Service, you shall make deposits into Sinq or withdraw from Sinq account using your phone.

- To get interest with ordinary Sinq, customers should deposit more than Birr 26.

- Types of Sinq Services

- Customers shall use ordinary or locked Sinq services.

- There are two ordinary Sinq interest free Sinq service and interest-bearing Sinq service.

- To use ordinary Sinq services, customers shall deposit any amount starting from Birr 1. However, to get interest, customers should deposit more than Birr 26.

- For locked Sinq, customers should deposit more than Birr 20,000 at a time.

- If customers save for 3 months, 6 months, 9 months, and 12 months, they shall get interest rate of 7.25%, 7.5%, 7.75% and 8% per annum respectively.

- If customer withdraw before the maturity period, the interest rate will be change to 7%.

- Governing Law

The laws of the Federal Democratic Republic of Ethiopia, the directives of the National Bank of Ethiopia, as well as the relevant procedures of the Commercial Bank of Ethiopia and Ethio telecom shall govern these Terms and Conditions.

- Queries

For any question related to services, process, terms & conditions of individual micro credit service, you can get through telebirr Customer contact Centre (by dialing 127).

- Termination

We shall be entitled to suspend or terminate this agreement wholly or partially due to your abuse, misuse, or fraud of any of the Sinq and loan services with or without prior notice to you. Any termination of this contract in completely or in part may not affect any accrued rights and obligations of either party.

- Complaints

Complaints may be made in person, in writing, by post, fax, email or by telephone. Ethio telecom will take all measures within its means to resolve your complaints within a reasonable time. If You are dissatisfied with the response, you can escalate the matter to Commercial bank of Ethiopia and National Bank of Ethiopia sequentially.

- Dispute Resolution

Any dispute arising out of or in connection with this Agreement that is not resolved as per Clause 11 above shall be referred to Federal court of Ethiopia with jurisdiction.

- Disclaimer

Your PIN must be kept secret and not accessible to anyone other than you. The consequences of disclosing the PIN, unauthorized use of the telebirr account, cell phone, or SIM card, failing to report loss or theft, or not regularly changing your pin are solely your responsibility.